As with any significant financial decision, you must evaluate the pros and cons of obtaining a reverse home loan as well as determine if it is best for you. The majority of these costs can be rolled into your lending, yet you can pay any one of them expense, if you want to pass up financing them. Talk to your lender to obtain the most updated prices as fees may transform gradually. You must participate in a counseling session from a Department of Housing and Urban Development-approved therapist for more information concerning the financing and also your alternatives. It is very important to bear in mind that a reverse home mortgage is still a lending and, as the homeowner, you still have obligations tied to the financing and also to the home.

The federal government requires you to see a federally-approved reverse home mortgage counselor as part of obtaining a HECM reverse mortgage. You continue to have the house, so you must pay the property taxes, insurance, as well as repair services. If you fall short to pay these, the lending institution can use the financing to pay or need you to pay the lending completely. You might intend to speak to a monetary advisor and also your family prior to getting a reverse home loan.

It https://bestcompany.com/timeshare-cancellation/company/wesley-financial-group?__cf_chl_captcha_tk__=rA.fq3k59aL4J9YbUz_GriOhlnKDMCKBU8dSsl8TtUs-1643107750-0-gaNycGzNBz0#reviews for that reason does not influence federal government benefits from Aging Protection or Ensured Revenue Supplement. Daniel Wong at Better Residence composed that, the jump stood for an 11.57% rise from September, which is the second greatest boost because 2010, 844% more than the mean monthly pace of development. The yearly boost of 57.46% is 274% larger than the mean annualized rate of development. Specific regulations for reverse home loan transactions differ depending upon the laws of the jurisdiction.

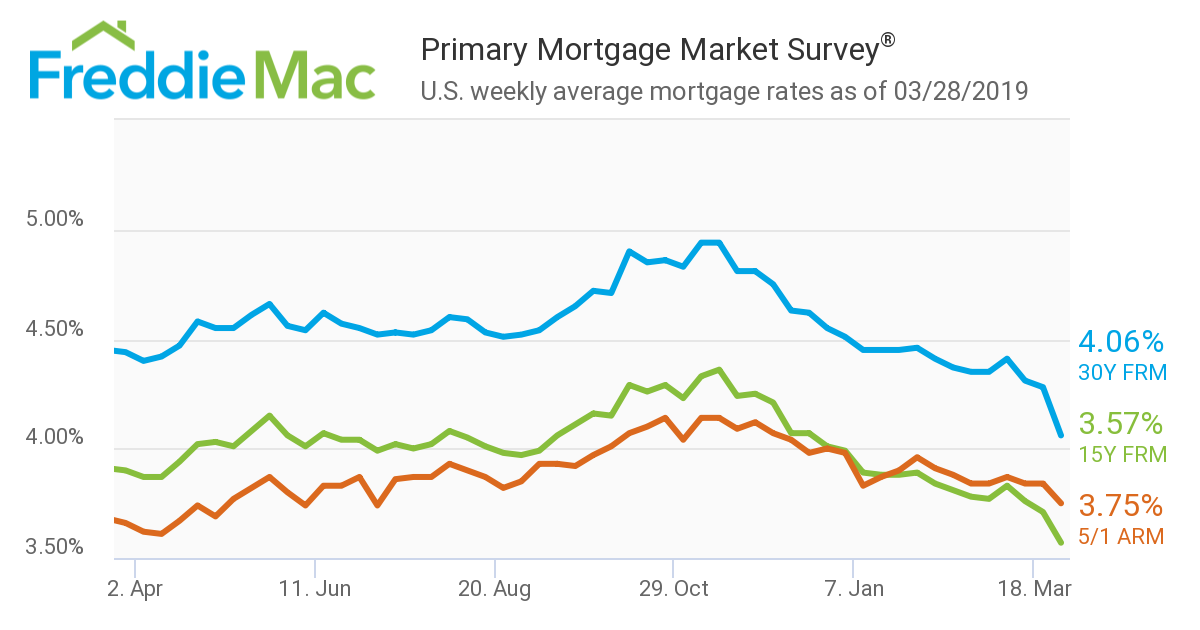

- Rate of interest on reverse mortgages presently sit at around 8%, which is higher than normal home mortgage rates of interest which are around 4-5%.

- When your lending is settled, you're ensured to have this selected percentage went back to you (up to 50%).

- HECMs have a "maximum claim quantity," which restricts just how much a homeowner can borrow.

- You don't require to make any kind of routine repayments on a reverse home loan.

The FBI, Inspector General, as well as HUD urge American consumers, particularly seniors, to be mindful when considering reverse home mortgages to stay clear of frauds. HUD particularly cautions consumers to "be cautious of scammer that charge thousands of bucks for details that is without HUD. With a HECM, there usually is no details revenue need.

What Are The 3 Kinds Of Reverse Home Loans?

The lender should additionally receive certification that the applicant in fact got the therapy. A reverse mortgage is an unique kind of car loan that supplies the possibility for property owners 62 years or older to borrow against the equity in their houses. The Minnesota Department of Business urges home owners to thoroughly assess their choices and find out about the costs and also threats involved with a reverse home loan before deciding. Reverse mortgages could be attractive options for senior citizens with limited earnings and also monetary uncertainty. Nevertheless, these kinds of home mortgages are difficult financial items that timeshare cancellation services reviews usually have significant prices and also risks that require to be thought about. While reverse mortgages might appear very appealing, there are some vital dangers and drawbacks to consider.

Compare By Debt Required

It is necessary to understand the threats as well as to have a plan I place in instance the worst feasible scenario happens. You can minimize the threat by limiting the quantity you borrow on the financing. If it is a tiny section of the total equity, you can offer the residence as well as have sufficient to acquire a smaller sized area live. Lenders wish to guarantee you don't wind up owing more than your house is worth, so they set a much greater first equity demand than routine home mortgage programs. A home assessment is always called for as part of the reverse home loan procedure to get an objective opinion of your house's value from a licensed real estate evaluator.

Reverse Home Mortgage Choices

The table below provides instances of major limitations for various ages and also EIRs as well as a residential or commercial property value of $250,000. An usual mistaken belief is that when the consumer passes away or leaves the residence (e.g., goes to an aged-care center or actions elsewhere) the house have to be offered. Hence, the beneficiaries of the estate might choose to repay the reverse mortgage from other sources, sale of various other properties, or even refinancing to a regular home mortgage or, if they certify, an additional reverse mortgage. The majority of reverse mortgages should be repaid when they leave the home completely. Nonetheless, the majority of reverse home mortgages are owner-occupier finances just to make sure that the consumer is not permitted to rent out the residential or commercial property to a lasting occupant and also move out.

HUD does place a higher need to timeshare attorney have a stronger credit history for borrowers wanting to buy a brand-new home. Yes, an assessment is needed on all reverse mortgage purchases. You could constantly think about a reverse home mortgage for the purchase of your next residence so that you can keep more of your money or get more house yet I don't suggest you use the reverse home mortgage for momentary financing.

If you get those kinds of monetary products, you might lose the money you get from your reverse mortgage. You don't need to acquire any economic items, services or financial investment to obtain a reverse home mortgage. As a matter of fact, in some circumstances, it's illegal to need you to buy various other products to obtain a reverse home mortgage. If you do not qualify for any one of these lendings, what options stay for utilizing residence equity to money your retirement?